littleton co sales tax 2020

Welcome to the City of Littleton Business SalesUse Tax E-Government Website. 192019 13750 PM.

Verify Why Colorado Gas Prices Are Higher Than The Average 9news Com

You can find more tax rates and allowances for Littleton and Illinois in the 2022 Illinois Tax Tables.

. The Arapahoe County sales tax rate is. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County. This Website allows you 24-hour access to sales tax returns and sales tax payments.

The Littleton sales tax rate is. 3 beds 2 baths 1272 sq. See reviews photos directions phone numbers and more for 2020 Tax Resolution locations in Littleton CO.

3 Cap of 200 per month on service fee. Alicia DeVore Created Date. You will need your City of Littleton SalesUse Tax Account Number Customer ID Number as well as your PIN Password.

This document provides the jurisdiction codes by county to ensure proper registration of locations for accurate filing and distribution of state-collected sales tax to local and special district tax jurisdictions. Condo located at 5628 S Curtice St Littleton CO 80120 sold for 569500 on Aug 7 2020. 05 lower than the maximum sales tax in NC.

To access the system Click on Login. Effective January 1 2019 we are required by law to collect and remit sales tax for all states as outlined in the chart below. The 875 sales tax rate in Littleton consists of 29 Colorado state sales tax 1 Arapahoe County sales tax 375 Littleton tax and 11 Special tax.

The County sales tax rate is 025. Thomas Mitchell November 5 2020 436PM. This is the total of state county and city sales tax rates.

CD of 010 consists of all areas within Arapahoe County Effective December 31 2011 the Football District salesuse tax of 010 expired within Arapahoe County. This is the Colorado Retail Sales Tax Return. Please note many states also require sales tax to be collected on shipping and handling charges.

The average sales tax rate in Colorado is 6078. 5 series 2020 6 7 an ordinance of the city of littleton 8 colorado amending section 3-9-1-2 and adding 9 section 3-9-1-8 of thelittletonmunicipalcode 10 regarding economic nexus and the 11 obligation of remote sellers to collect and 12 remit sales tax 13 14 whereas the city of littleton colorado the city is a home rule. The current total local sales tax rate in Littleton CO is 4250.

View sales history tax history home value estimates and overhead views. Since taxable categories vary by state please see the table below for a summary of states and taxable categories. You can print a 875 sales tax table here.

Apply now for Sales Tax jobs in Littleton CONow filling talent for End of year tax prep Tax returns for 2020 final tax return for closing buiness. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Littleton in Illinois has a tax rate of 725 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Littleton totaling 1.

This is the total of state county and city sales tax rates. You can print a 7 sales tax table here. The minimum combined 2020 sales tax rate for Littleton Colorado is.

Effective January 1 2022 businesses should begin. Did South Dakota v. Twelve Colorado Towns Voted on Retail Marijuana Sales and Taxes.

The December 2020 total local sales tax rate was 7250. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. The 2018 United States Supreme Court decision in South Dakota v.

2020 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. 1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee. What is the sales tax rate in Littleton Colorado.

The Colorado sales tax rate is currently 29. 4 Sales tax on food liquor for immediate consumption. For tax rates in other cities see Colorado sales taxes by city and county.

There is no applicable city tax or special tax. For tax rates in other cities see North Carolina sales taxes by city and county. Littleton voters approved a 075 sales and use tax rate increase in November 2021 to fund capital improvement projects and ensure long-term financial stability.

The minimum combined 2022 sales tax rate for Littleton Colorado is 8. The Colorado sales tax rate is currently. Marijuana wasnt a statewide issue in the November 3 election but cannabis.

The 7 sales tax rate in Littleton consists of 475 North Carolina state sales tax and 225 Warren County sales tax. The Littleton sales tax rate is 375. See reviews photos directions phone numbers and more for Sales Tax locations in Littleton CO.

Method to calculate Littleton sales tax in 2021. Sales and use tax rate increase in 2022. The Littleton Colorado sales tax is 725 consisting of 290 Colorado state sales tax and 435 Littleton local sales taxesThe local sales tax consists of a 025 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

10895 W Bowles Pl Littleton CO 80127 510000 MLS 8410048 Fantastic three bedroom one and three quarter bath single family residence in Powderho. Footnotes for County and Special District Tax.

File Sales Tax Online Department Of Revenue Taxation

Ashwood Vantage Homes Colorado Homes House Styles Home

File Sales Tax Online Department Of Revenue Taxation

Business Sales Use Tax License Littleton Co

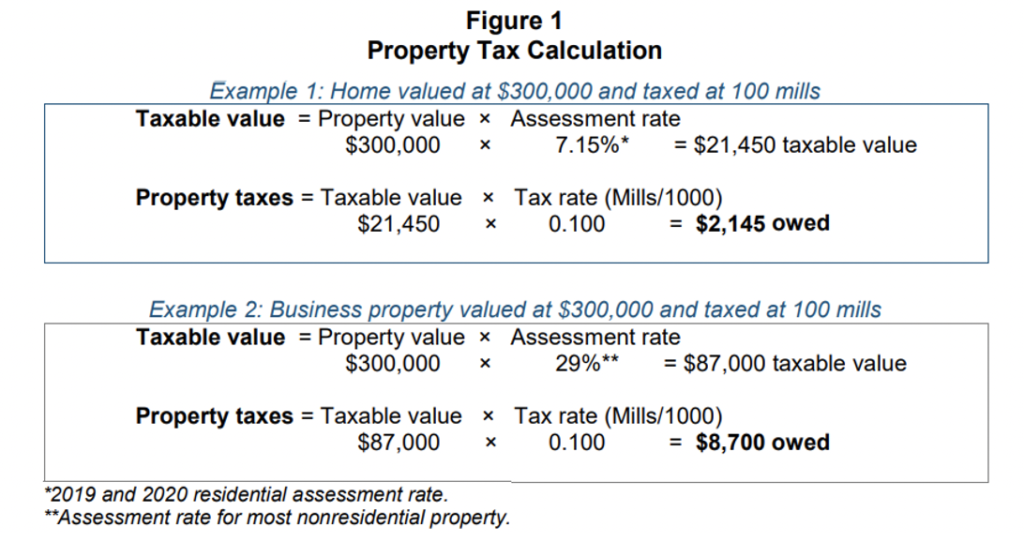

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Sales Tax Rates Douglas County Government

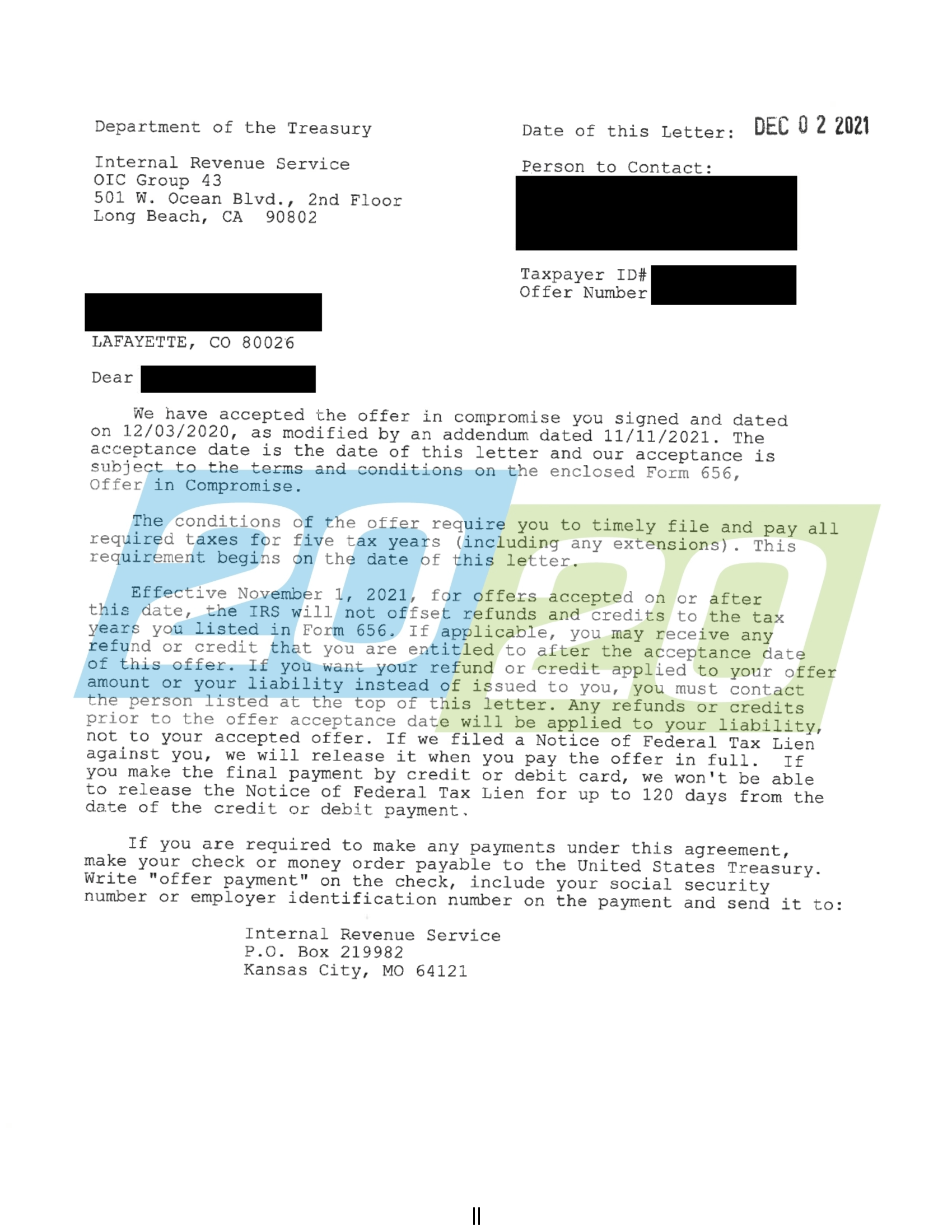

Tax Resolutions In Colorado 20 20 Tax Resolution

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Tax Resolutions In Colorado 20 20 Tax Resolution

File Sales Tax Online Department Of Revenue Taxation

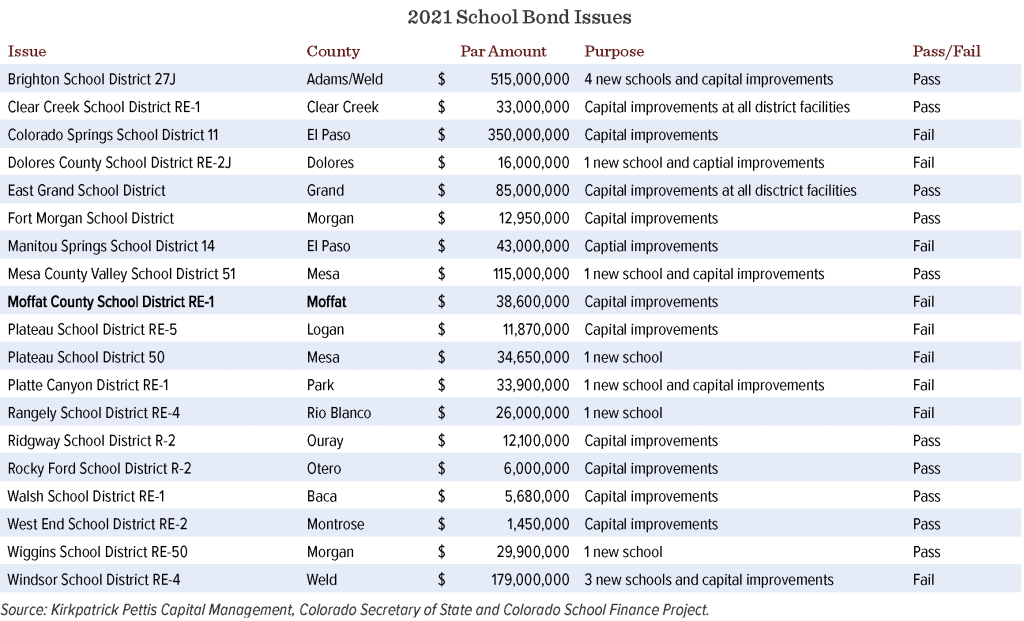

2021 Colorado Local Bond Measure Election Results Aquila Group Of Funds

Tax Resolutions In Colorado 20 20 Tax Resolution

Colorado Sales Tax Rates By City County 2022

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Sandstone Ranch Trail Douglas County Government

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute